- Mon - Fri: 8.30 AM - 5:00 PM

- 26565 Agoura Rd., 200, Calabasas, CA 91302

- 818-884-8075

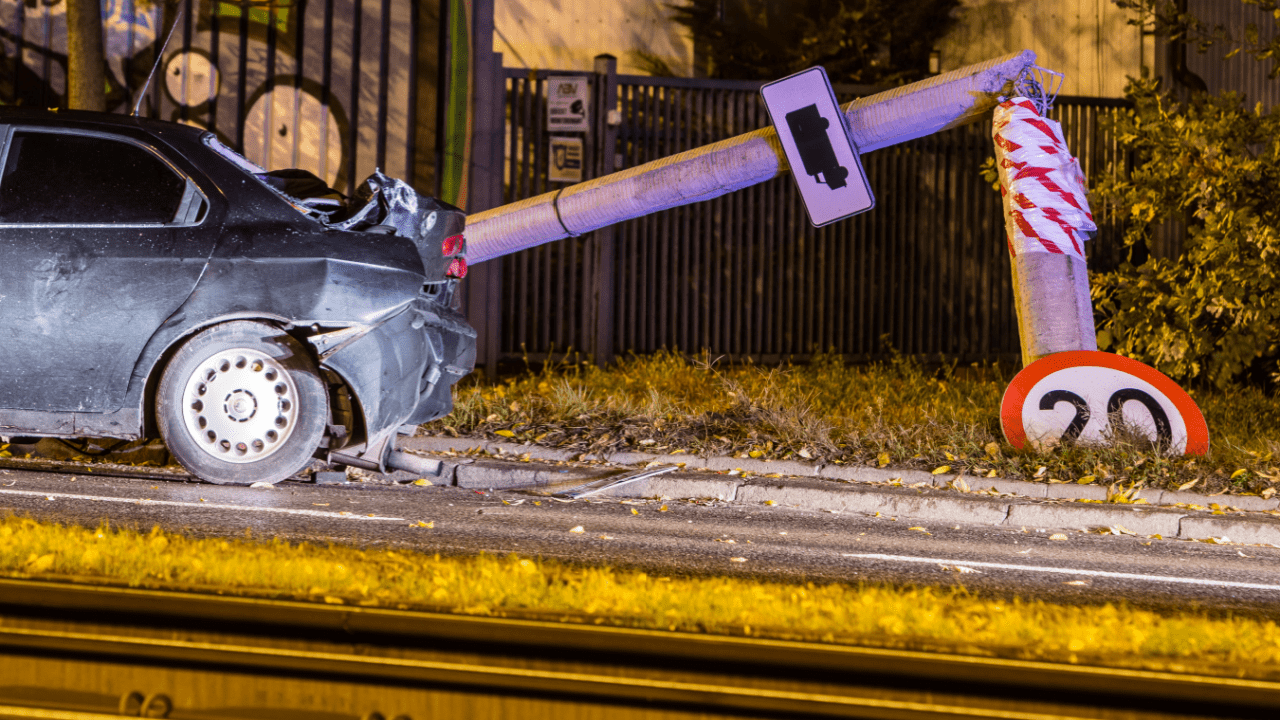

What Happens If You Get Insurance After an Accident? Coverage Rules Explained

What Happens If You Get Insurance After an Accident and Try to File a Claim?

What happens if you get insurance after an accident? Whether your policy had lapsed or you were driving without coverage altogether, being involved in a crash without active insurance puts you in a difficult position. Can you still file a claim? Will your new policy cover the damage? Here’s what you need to know.

Unfortunately, the short answer is no—you cannot buy insurance after a crash and expect it to cover that accident. Car insurance is designed to protect you from future events, not ones that already occurred.

In this article, we’ll break down what happens if you get insurance after an accident, why retroactive coverage isn’t allowed, and what you can do if you’re already dealing with an uninsured crash.

Can You Buy Insurance After a Crash Occurs?

Yes—you can buy insurance at any time, including after an accident. However, your new policy will only cover incidents that happen after the effective date. It won’t apply to anything that occurred before you enrolled.

So, what happens if you get insurance after an accident? You’ll be covered going forward, but your new insurer will not help with any claims related to the crash that already happened.

Why?

Because insurance companies take on risk in advance. If they allowed people to buy coverage after something bad happened, it would undermine the entire system—and raise costs for everyone.

For drivers looking to get back on track, consider working with a provider that offers exclusive auto accident leads to connect with legal professionals experienced in uninsured claims.

Why Insurance Won’t Cover the Past

You can’t call your insurance company after you’ve already had an accident and expect them to help. That’s because policies cannot be backdated to cover prior events.

Here’s why that matters:

- If you try to hide the accident when buying a policy, it may be considered fraud

- Most companies ask if your vehicle has been damaged or if you’ve had any recent incidents—lying on these questions can void your coverage

- Once the provider discovers the accident occurred before your policy started, they’ll deny any related claims

So, what happens if you get insurance after an accident and try to file a claim? At best, the claim will be denied. At worst, you could face legal consequences for insurance fraud.

For more insights, sites like TrafficAccidents.com offer breakdowns of what’s legally required after a collision.

Legal and Financial Consequences of Being Uninsured

Driving without insurance isn’t just risky—it’s illegal in almost every state. If you were involved in an accident without coverage, you could face serious penalties, whether you were at fault or not.

Possible consequences include:

- Fines and court fees

- Suspension of your license or vehicle registration

- Points on your driving record

- Increased premiums when you do get insured

- Being held personally responsible for all damages, including the other driver’s medical bills and car repairs

If you’re at fault in the accident, the financial burden can be devastating. You may be sued by the other party, and you could be forced to pay out of pocket or through wage garnishment.

So, what happens if you get insurance after an accident? Legally, you may still face consequences from driving uninsured—even if you buy a policy afterward.

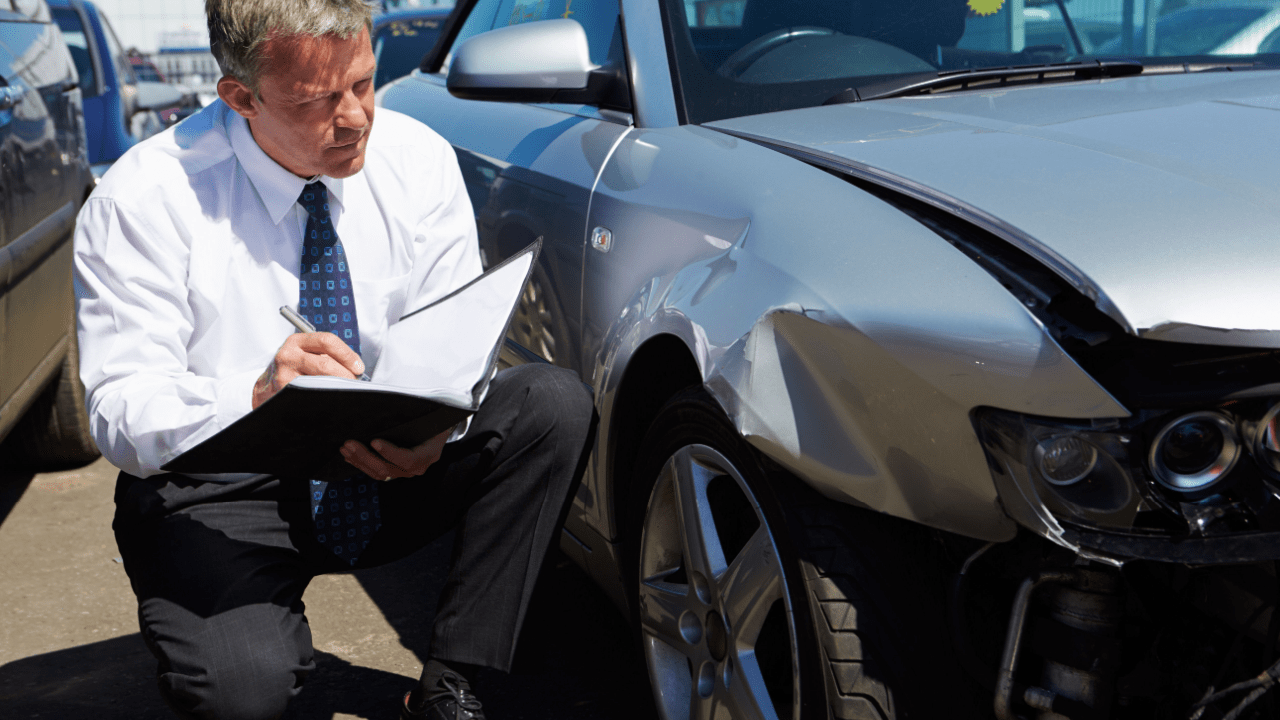

What You Should Do After an Accident Without Insurance

Getting into an accident without coverage is a stressful experience, but you still have options.

Steps to take:

- Stay at the scene and exchange information with any other parties involved

- Call law enforcement to report the accident—some states require this, especially if there’s injury or property damage

- Take photos and document everything for your own records

- Don’t try to get retroactive insurance—this won’t help and may get you into more trouble

- Consult an attorney—if someone is injured or threatens to sue, legal advice is critical

- Get a quote for future coverage—being uninsured now doesn’t mean you can’t fix it

Be honest with your future insurer. Many companies offer non-standard or high-risk policies for drivers with gaps in coverage, and it’s better to move forward with the right protection.

If your situation is complex, consider reaching out to firms that handle criminal defense leads involving uninsured or high-risk drivers.

Can You Get Coverage After an Accident? Know What to Expect

So, what happens if you get insurance after an accident? You can still get insured for future incidents—but it won’t help with the crash that already happened. Retroactive coverage isn’t available, and filing a claim for a past event is not only ineffective, but potentially fraudulent. While driving without insurance comes with legal and financial consequences, taking steps now—like getting covered and speaking with an attorney—can help protect you moving forward. Don’t compound the mistake by trying to backdate coverage. Instead, focus on regaining compliance and avoiding greater liabilities.

Need Legal Help After an Accident Without Insurance? Take Action Today

If you were in a crash and are now wondering what happens if you get insurance after an accident, Legal Brand Marketing is here to help. We connect uninsured or high-risk drivers with experienced attorneys who understand how to navigate legal consequences, insurance disputes, and financial liability. You don’t have to face the aftermath alone—professional guidance can make all the difference in protecting your rights.

Contact us today to get connected with the right legal support and take control of your next steps.

Frequently Asked Questions (FAQs)

1. Can I get insurance the same day after an accident?

Yes, you can purchase a policy the same day. However, the coverage will only apply to future incidents—not the accident that already occurred.

2. Will my new insurance company know I was recently in an accident?

Most likely, yes. Insurance companies often review your driving record and ask about recent claims or vehicle damage during the application process.

3. What if the other driver was at fault and I didn’t have insurance?

You may still recover compensation through the other driver’s liability coverage, but you could face penalties for being uninsured, depending on your state’s laws.

4. Can I be sued if I didn’t have insurance during the accident?

Yes. If you’re found at fault and uninsured, the other party can sue you for damages. Even if you weren’t at fault, you may still face legal and financial penalties for driving without coverage.

5. Are there insurance companies that accept high-risk or uninsured drivers?

Yes. Many insurers offer non-standard or SR-22 policies specifically for drivers with lapses in coverage, prior accidents, or high-risk status.

Key Takeaways

- Insurance policies do not apply retroactively—you cannot get coverage for an accident that has already happened.

- Filing a claim for a past accident under a new policy may be considered fraud and could result in legal action.

- Driving without insurance can lead to license suspension, fines, and personal liability for damages.

- Getting insured after the fact protects you moving forward but does not resolve your current legal or financial situation.

- Honesty with future insurers and legal guidance are essential if you’ve had an accident without active coverage.